What could GB Energy do?

Now Labour have won the election there is one question on the lips of everyone in the energy industry: What is Great British Energy? We won’t know for some time. Very sensibly Labour haven’t given it too specific a definition that would tie its hands. The better question is: What could GB Energy be?

From the public statements by the Labour party and the musings of commentators, we at least have an idea of the options. I agree with Flints’s excellent framework. GBE Energy could have three roles: (1) Energy transition delivery agency; (2) State investment vehicle; (3) Publicly owned energy developer. Under each role there are more specific activities that GB Energy could undertake.

[DISCLAIMER: the following section articulates the options for GB Energy based on what I have read or heard discussed. I am not taking a view.]

Role 1: Energy transition delivery agency

Activity 1: Central planner and coordinator

GB Energy convenes and coordinates with various governmental and public sector bodies to accelerate decarbonisation. It is unclear how GB Energy would interact with the new National Energy System Operator.

Activity 2: Procurement aggregator

Given the significant constraints in the supply chain, GB Energy could act a procurement aggregator. For example, adding up all the transformer and cable orders across the electricity networks and buying in bulk from the likes of Siemens. Another suggestion is that GB Energy provides a downpayment on behalf of the network companies for equipment orders to help them secure slots in production queues. The argument goes that the state has a lower cost of capital, so it costs less for it to make these downpayments.

Role 2: State investment vehicle

Activity 3: Scale up immature technologies.

GB Energy invests money – debt and equity – into nascent technologies that need to be scaled up. It could do this on its own or with private sector co-investment. The kind of technologies mentioned are offshore floating wind, long duration energy storage, and carbon capture and storage. This would overlap with the UK Infrastructure Bank. The rationale is that these technologies are very immature, so the risk is too high and payback period to long/uncertain for private sector companies to invest. Investors would require a very high cost of capital. The state can use its lower cost of capital to incubate these technologies.

Activity 4: Scale up mature technologies.

This is the same to sub activity 3, except GB Energy is investing in more mature technologies to broaden their reach. This could be at the transmission level, through investment in offshore wind, or at a distribution level through community energy projects (e.g. solar on schools).

Role 3: Publicly owned energy developer

Sub activity 5: End to end generation developer

GB Energy develops, finances, constructs and operates energy generation assets. Could be onshore or offshore, independently or in partnership with the private sector. Takes inspiration from Vattenfall or EDF.

Activity 6: End to end network builder

GB Energy injects competition into networks. It develops, finances, constructs and operates energy network assets. Could be in electricity or hydrogen (if there is anything worth building). This was a feature of early Labour party statements but has died away. As Rachel Reeves said in October 2023 ‘Labour will open up new grid construction to competitive tendering, with GB Energy looking to bid into that competition to build or co-build that new grid where necessary.’

Activity 7: Mothballing and decommissioning

Richard Lowes has argued that GB Energy should take ownership of the gas distribution networks and executes their decline and decommissioning. Lowes’ argument is:

“It’s just not appropriate for… [investors]… to be looking to maximise profits from a sector which needs to rapidly decline and which continues to lobby for false solutions like hydrogen. This operation could ensure all potential asset stranding costs are paid back equitably. To be clear, this would still be regulated by Ofgem and would be a for profit business while investments were recouped. This could help manage some of the current concerns around executive pay and asset stripping.”

The state is often called on to solve collective action problems of this nature, and specifically to decommission assets (as it was in the early 2000s to deal with nuclear decommissioning). In nuclear decommissioning the argument goes that it would be inappropriate for private capital to be used because you wouldn’t want the profit motive to lead to compromises on safety.

Activity 8: Strategic reserve operator

GB Energy takes responsibility of some strategic reserve components of the energy system. It will be very difficult to develop long duration energy storage assets on a commercial basis. Markets are very bad at pricing low probability high impact events, and the cost of capital could be too high to get a viable system of LDES off the ground. This system would be an insurance policy like having an army and navy.

The nationalized gas industry 1948-1980: A former Great British Energy

In the discussions about GB Energy there is often a common underlying assumption; the state is no good at running energy systems. Economic history is often invoked as proof. People will point to the Central Electricity Generation Board that ran the electricity system from 1948 to the mid-1980s and claim that it overbuilt generation capacity, was inefficient, and made some very wrong bets in nuclear. In other posts I have argued this is a dubious argument. But for the purposes of this blog let us look at the forgotten twin of the CEGB, the nationalised gas industry. Between 1948 and 1980 the Gas Council and then the British Gas Corporation executed a remarkable transformation of the energy system. It excelled in every one of the roles discussed above.

Role 1: Energy transition delivery agency

In the early 1950s the gas industry seemed moribund in the face of electrification. Just as the lightbulb had replace the lamplighters so too would electricity replace gas. However, in the 1960s the newly nationalized industry made a series of technological breakthroughs – deriving gas from oil, importing Liquified Natural Gas and then bringing natural gas from the North Sea onshore. The Gas Council coordinated all of this. It started first with driving up demand. In the 1950s and 1960s the council ran some of the most successful marketing campaigns in history. The ‘High Speed Gas’ campaign of the 1960s drove up gas demand before natural gas was discovered. Fanny Cradock taught people how to cook triple cooked chips in a Gas Council film in 1963. ‘Mr Firm burns to serve you’, an anthropomorphic dancing flame, was one of the best-known advertising campaigns of the post war period.

The discovery of natural gas in the North Sea presented an opportunity and a challenge. It had a different chemical composition to town gas made from coal. Most household and industrial appliances would need to be changed. The ensuing conversion programme was extraordinary. 13.4 million customers and 37.4 million appliances were converted in 10 years. The British conversion program was the most successful in the world. The Dutch only managed 2 million customers in 5 years, and the Japanese only managed 5 million customers in 10 years.

The complexity of conversion was breath-taking. A census of appliances between 1967-9 revealed there were nearly 8,000 different types of appliances that needed to be replaced or adapted. To deal with such a broad array of appliances required ~4000 different conversion sets, with 1400 conversion procedures. It was all put together with Lego like instructions. For each appliance there was a standard conversion set and a procedure to help the gas fitter work at pace. Information constantly flowed back and forth between the engineers on the front line and the Technical Advisory board. Storerooms were set up around the country, like vast Amazon warehouses, all employing the latest inventory management techniques.

Figure 1: A conversion kit warehouse.

The coordination of infrastructure planning and customer engagement was remarkable. It all started with a pilot in Canvey Island to test and learn how to do conversion at scale. Once the methodology was honed, it was rolled out nationally. Each gas Area Board would plan when a household would undergo conversation to coincide with the retrofitting and replacement of the network to carry natural gas. Within 10 hours of ‘C-Day’ all essential appliances were setup for natural gas and the network would turn the gas back on. All of this was done at no cost to the end consumer. Behind the scenes the Gas Council gained agreement from all the equipment manufacturers to only provide natural gas appliances from 1968. It imposed a new set of standards, all set by the gas industry’s world class research facility Watson House. It built a huge workforce of installers who were given good pay and long-term benefits. It also coordinated a remarkable public relations campaign to educate the public.

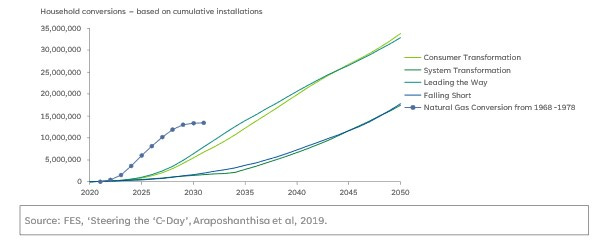

To put the scale of conversion into modern context, the gas industry executed at a pace that far outstrips what the National Energy System Operator is projecting is needed for the heat pump conversion program over the next ten years.

Figure 2: Heat pump conversion projected by the National Energy System Operator 2020-2050, and Natural Gas Conversion from 1968-1978.

Role 2: State investment vehicle

It is conventional wisdom that when it comes to energy technologies, the state is bad at picking winners. People always point to Britain’s nuclear programme. The nationalised Central Electricity Generation Board failed to buy US PWER technology in the 1960s and went with the UK AGRs. This was despite the overwhelming evidence that using standardised designs from abroad would have been much cheaper. But few point to the very successful long term technology bets that the gas industry made in the 1950s and 1960s.

Firstly, there was the invention of new ways to make gas in the 1950s. The catalytic rich gas (CRG) process was first developed at the Bromley-by-Bow gasworks of the North Thames Gas Board. The technology was eventually made redundant by the advent of natural gas, but it was licenced to other countries including France and Japan. The more significant innovation was the gas recycle hydrogenation (GRH) process to derive gas from oil. It was developed at the gas industries Midlands Research Station, and then quickly scaled up in Bristol before being licenced in Germany. These oil to gas technologies were cheaper than coal to gas technologies, and gas started to win market share from electricity.

Secondly, there was Liquified Natural Gas. In the USA the gas industry has been exploring how to store gas without using large and expensive gas holders from the 1920s. Trials of liquifying gas started to make progress in the 1950s. The Gas Council pounced and decided to convert a 5000-ton dry cargo vessel into a liquified natural gas tanker capable of carrying 2000 tons of gas over the Atlantic. The Methane Pioneer was completed in 1958. Its first crossing was in 1959 to a specially constructed terminal at Canvey Island, Essex. 13,000 tons of liquified gas were imported in this trial – a first of its kind in the world – in a period of a year.

Spurred by the success of the trial, the Gas Council hatched an even bolder plan; import liquified natural gas on boats from the Sahara (the Methane Princess and the Methane Pioneer), land it in Essex and pipe it up to Leeds. In 1962 work began on a high-pressure pipeline 200 miles long from Canvey Island to Leeds. The trunk line would have multiple spurs so 8/12 of the area boards could access the new gas. The impact for the customer was minimal. But the industry and its engineers had now acquired the ability to build networks at sale. Finding natural gas in the North Sea may have been luck, geologically speaking. But the ability to bring it onshore was anything but. It was all thanks to the dynamic efficiency of the gas industry.

Role 3: Publicly owned energy developer

With the discoveries of oil and gas at the West Sole Field in the North Sea 1965, the British state had to make a big decision on how to develop the offshore infrastructure. It was clear it would be extremely expensive. The Gas Council had shown itself to be an extraordinary engineering organization, but it had no experience in extraction. There was also a huge amount of risk involved, as it was uncertain which fields would end up producing. The government decided to let private sector companies take the risk and prospect for resources. The Gas Council would then purchase the gas under long term contracts.

The Gas Council focused on synchronizing the in-home conversion program and building a new national network of pipelines. It became exceptional at building networks. Between 1967 and 1979 the industry built 3047 miles of pipeline, a rate of 227 miles per year. In the peak build years of 1967 and 1968 the Gas Council was building 600 miles per year.

The gas industry was only able to take advantage of LNG and natural gas because it took on vested interests. In 1948 there were 1000 disparate gas supply undertakings. Nationalization created a single organization with better financial resources. By 1963 there were only 428 gas supply undertakings. Natural gas conversion would have never happened without this consolidation. The private sector gas undertakings would have sought to protect the value of their existing assets, created for town gas, and would have frustrated the pace of conversion.

Implications for GB Energy

The story of the Gas Council should be a cause for optimism about the good that GB Energy can do. Pessimists that say the state shouldn’t get involved in energy are generally folks with a very selective historical memory. They talk about the CEGB and nuclear but never about the Gas Council, LNG and conversion. The Gas Council performed almost all the roles and activities that GB Energy could do. It only really stayed out of offshore exploration and production because private sector organisations were more capable and were willing to take the risk. The equivalent today is offshore and onshore wind, large scale solar and batteries. GB Energy could become like Vattenfall, but the fact Vattenfall already exists means there is less of a need for a British version of it.

Figure 3: Comparison of the roles GB Energy could play and what the nationalised gas industry did.

What can GB Energy feasibly do with its limited resources? It will have a capitalization of £8Bn over the next parliament, with £3.3Bn allocated to community energy. The UK Infrastructure Bank has £23Bn. In 1965 the Gas Council was given a capitalization of £19Bn in today’s prices, plus billions in annual revenue. So, GB Energy is going to have to make some choices about what it does. As Richard Lowes has argued, GB Energy should focus on where it complements the activities of other private and public sector organizations, and where it can resolve problems that markets won’t solve.

The nationalized gas industry was a supremely effective energy transition delivery agency. The issue for GB Energy is that with the establishment of the National Energy System Operator, it is unclear what a new planning and coordination agency would add. The Gas Council was also superb at building networks, but that requires lots of financing and GB Energy’s budget won’t stretch very far. It could try to centralize procurement, but that would rely on the networks being able to specify what stuff they want to buy in a timely manner. Centralizing procurement would move the decision making even further from the engineers on the front line.

One area where GB Energy can have the biggest value add is as a scaler of immature technologies. The nationalized gas industry excelled at incubating immature technologies and scaling them up. The equivalent for GB Energy could be offshore floating wind or long duration energy storage. Technologies that are big bets, with high uncertainty, where the cost of capital will be extremely high.

Another area GBE Energy could focus, as argued by Richard Lowes, is managing the end of life and decommissioning of the gas networks. Lowes and other commentators have made the case that the current approach is heading for issues for four reasons.

1. The risk of asset stranding: Based on this piece by Regen.

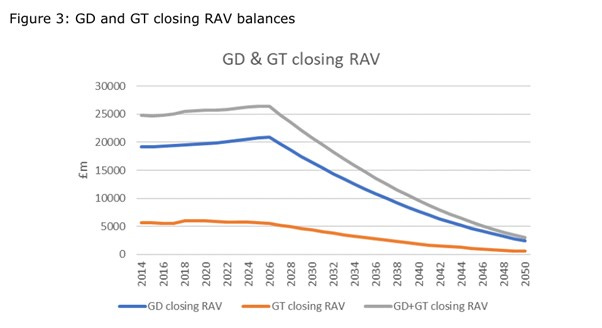

Under the current regulatory model network owners make investments in energy networks which are then paid for by customer network charges to cover depreciation and a return on investment. Assets are depreciated over 45-years. On the current trajectory, Ofgem estimates about £3Bn of residual Regulated Asset Value in 2050. Any investments during the next regulatory period will increase the outstanding asset value in 2050. Ofgem also points out that reaching Net Zero in 2050 is incompatible with fossil gas assets having economic value beyond 2050. This creates a dilemma… if there aren’t any methane network users in 2050 who will pay for the £3Bn plus?

Figure 4: Gas Distribution and Gas Transmission closing RAV balances

Source: RIIO-3 Sector Specific Methodology Consultation – Finance Annex, Section 8, Figure 3.

2. The rising cost of capital for the gas distribution networks: Based on this piece by Richard Lowes.

The state has a lower cost of borrowing than private companies. In the case of the gas networks that delta could increase. Utility Week reported that Cadent has pointed out to Ofgem that there is already evidence that asset stranding risks are affecting the cost of both debt and equity investment: “European comparators and debt market cross checks point to a premium being applied today that needs to be included in the assessment of an appropriate cost of capital.”

3. The significant cost of decommissioning and the long-term liabilities: Based on this report by Arup for the NIC in October 2023.

Arup estimated the cost of decommissioning to be between £17Bn and £25Bn. But that estimate is very uncertain because it is unclear what decommissioning will entail. There isn’t really a plan, and no funds have been set aside, as the Public Accounts Committee noted recently. Setting up a commercial regime to pay for-profit companies to decommission is challenging. With a cost pass through the company has no incentive to be efficient and if it has other business lines that are simultaneously trying to make a profit it will try to allocate costs to the program with a cost pass through. With a fixed price the company has a huge incentive to be efficient, but this could incentivize cutting corners with obvious safety implications. A fixed price creates a huge burden on the regulator to specify very precisely what decommissioning should entail. Such a high degree of specificity won’t be possible. The state will likely become heavily involved anyway. As the Arup report notes ‘in the event the networks are decommissioned, there is likely a need for an entity to remain in order to maintain site security and hold the ongoing legal liability associated with the remains of the network. An example of this is the Coal Authority’.

4. The risk of dramatic increases in charges to customers. Based on this by Frank H at Regen.

As the number of customers falls and gas consumption falls, the energy unit cost of gas network charges could rise rapidly from 2030 onwards. Ofgem has estimated that network charges could reach 10p/kWh by 2040 and 40p/kWh by 2050. Network charges could accelerate earlier and end up higher if (a) Ofgem accepts an accelerated depreciation schedule, (b) more investments are made in the network, or (c) decommissioning costs are added. All three are going to happen.

This could set off a spiral. As Frank Hodgson notes

“Increasing network charges would likely create a feedback loop as households and businesses will be incentivized to switch away from gas, raising network charges further. While many will see this as a positive and necessary step to drive the transition to net zero, the ramifications for those customers still using gas could be enormous. Higher charges will raise the issue of fairness. Those consumers still using gas for heating in the late 2030s and into the 2040s may well be doing so because it is difficult for them to switch (such as those with lower incomes and the fuel poor, or people who cannot make the decision unilaterally like renters or people living in shared buildings of flats). Is it fair that those people pay for the remaining RAV balance while everyone else dashes to the exit? Ofgem is right to highlight the issue of fairness here.”

Conclusion:

GB Energy should be encouraged by history. What the nationalized gas industry accomplished between 1948 and 1980 was remarkable. It fulfilled all but one of the roles that GB Energy could take. The Gas Council did, however, stay away from trying to scale up technologies where the private sector was highly mature. Where the nationalized gas industry excelled was incubating immature technologies and resolving collective action problems like conversion. If GB Energy were to follow that lead it would (a) focus on scaling technologies like offshore floating wind and long duration energy storage, and (b) focus on thorny issues like the end of life of the gas networks.

Mr. Downing -- I've got a question for you.

How really strong is your interest in the "History of Energy" - and what the History of Electricity "actually is"?

I'm asking because you don't list Nikola Tesla anywhere.

So, to rectify that - I'm offering you the US Patented / documented facts - that after 1882, when Nikola Tesla discovered and US Patented the multi-phase AC power system that the world uses today; I have uncovered the fact that between 1890 and 1894:

--- he then discovered, invented and US Patented -- all the information (some unclaimed) required to "electronically develop", i.e., "no revolving generator(s)":

--- all the clean electricity the world would ever need".

He then incapsulating that information in his US Patent for the Radio,

--- granted on Mar. 20th. 1900 -- in the form of the "resonant tank circuit" found in every AM or FM Radio.

I've read your article above concerning GB Energy, "and what it could be".

It is extremely well written and thought out -- and your piece only includes "the 'standard ways' of producing electricity" when equating to what GB Energy should do.

This is probably one of the reasons that Sir Michael recommended your sub- stack - because - on that basis - your good - really good.

What I am sending you here (and Sir Michael has been sent the same information): -- and it is totally unimportant as to whether or not either of you agree or accept the facts I'm listing below:

--- "what-is-fact" - is that a Nikola Tesla based:

--- US invented (1982);

--- US developed and pro. lab tested verified (1984 - at 293% continuous "over-unity" power production while powering a useful load;

--- US Patented (1992); electric power supply -- has been designed and built to be installed:

--- "at" any site, "stationary" or "movable", i.e., vehicular;

--- continuously produce all the clean electricity required "for" that site;

--- for as long as is required "by" that site;

--- without having to be connected to any external power source of power grid:

is available to the UK Government to use through GB Energy

It "accomplishes all of the above":

--- because it uses the exact same "tuning circuitry" found in all of those AM or FM radios manufactured and used over the last 124 years.

It's just been "put on steroids" - to produce "standard" electricity - like the single-phase 230 - 240 VAC / 50 Hz / power required within the UK:

--- along with matching ever other major AC power system in use around the world today.

It accomplishes that -- even though the Classic Physics' stated position, put in place long before Nikola Tesla started his seminal work on AC power -- that:

---"...no power supply can produce more power out than input power -- thus 'over-unity' is impossible...":

is correct as far as a "position" -- but it is "stated" totally incorrectly.

Had the "position" been stated that:

--- "...no power supply can develop more power than it is physically and electrically capable of producing..." -- the statement would be correct.

The original statement was proven totally incorrect - by tests conducted on a Tesla based electric power design - by:

--- Northwest Laboratories of Seattle WA Inc. (est.1896);

--- at 293% "over-unity"

--- on Sept. 10th. 1984;

with a later, solid-state design being granted:

--- US Patent 5,146,395 / A POWER SUPPLY INCLUDING TWO TANK CIRCUITS / with "regenerative feedback" / all 16 claims being granted in full without any changes or redactions:

--- on Sept. 8th. 1992.

The power supply is now designed to "selectively" produce up to and including:

--- 480 VDC or VAC / 480 Amps - which equals

--- 230,400 Watts; 230.4 kW; or .2304 MW per 2.5 cu. ft. solid-state / 30 lb. / modular /$2000 unit.

The present electric power supply design is a solid-state / small / lightweight / modular / inexpensive / "stand-alone" / electric power supply.

It has the designed capability to besides matching all major AC power systems in use around the world today -- it can also used to:

--- "repower" all battery or ICE (internal combustion engine) powered vehicles, of any size, shape , or weight - be that vehicle on land; sea; or in the air (including hi-bypass jet powered private or commercial aircraft -- making available

--- unlimited range of travel and or movement, and

--- unlimited time of travel and / or movement.

It is very material as to whether or not you believe the above information -- because

--- EC President Ursula von der Leyen and her Government believe it:

--- having officially requested that an application for funding be made through the EC Horizon Europe funding program be made - this last March after receiving the same above information.

That application has been shifted to the EC / EIC Accelerator for Breakthrough / Disruptive Technology funding program --for a speedier, more complete use of the power supply in Europe - and elsewhere.

It is very material to the UK - because the new GB Energy "could":

--- use this power supply (as you describe above) - in:

--- "activities 2 through 6" - (described in your article above) besides:

--- creating new jobs in manufacturing / installing and maintaining the power supply -- for both domestic and export around the world:

--- because the power supply can fill the present world-wide demand for clean / cheap / electricity.

Or - the leaders of the new Labour Government can face the UK electric bill payer / vehicle fossil-fuel purchaser / voter's wrath when they find out that the leaders in the new Labour Government - denied them "clean / cheap / electricity" -- first:

--- because they will have to import the power supply from EC / European sources -at a much higher cost:

--- when they could have them domestically produced.

I can produce all of the validating documentation f you like - or you find it on my LinkedIn site at"

"Richard L. "Scott" McKie -- The POD MOD Project" and contact me through LinkedIn.

History may not be correctly portrayed - as is the case -- as we now have the Global Warming / Climate Change disaster on our hands:

--- because we've been burning fossil-fuels for producing electricity and powering vehicles since the the Industrial Revolution:

--- but it does not lie.

We have had the information on how to produce all of the clean electricity we would ever need for over 124 years.

"We just didn't look for it - because we had been incorrectly taught by the Science of Classic Physics that "...over-unity" was impossible.

Big mistake.

---