Without Foundation

A critique of the essay Foundations by Bowman, Southwood and Hughes

Summary

The argument in Foundations goes as follows. Britain’s economic woes are because the planning system ‘bans’ investing in certain things (housing, infrastructure, energy). There is nothing fundamentally wrong with the economy. We don’t need the state to increase investment levels. It would actually be a bad idea, because nationalisation under the Attlee government led to underinvestment and caused Britain to fall behind other countries. We just need to remove planning restrictions and the private sector will build things, as it did in the first half of the 20th century, the 1980s and the 1990s.

This response argues that Foundations is flawed.

(1) There is very little evidence that Britain’s planning system is worse than other countries. So planning alone cannot explain why Britain invests less in certain asset classes.

(2) The immediate post war period (1947-1970) was not a period of underinvestment. Quite the opposite, it involved a number of mega projects; electricity and gas grids, power stations, nuclear, gas conversion, reservoirs. A constant decline in investment in fixed assets started in the 1990s.

(3) Blaming nationalisation for Britain falling behind France and Germany in the late 1970s makes no sense given France and Germany were more nationalised economies.

An alternative view is that underinvestment is due to bigger problems with the British economy and in particular the privatised model. Privatisation incentivised asset sweating not asset building. It significantly reduced investment in long term unprofitable bets (like nuclear). It created extraordinary complexity which eroded coordination between parts of the value chain. Governments and regulators intervened in markets, creating all manner of ‘distortions’. This led to the absurd situation in energy where wind farms are paid billions to turn off. The political consensus since the 1990s has ‘banned’ paying for certain types of infrastructure from general taxation (water, energy, housing). That means paying from bills today or bills in the future. Bills today are at the limit. Sadly we have already turned to borrowing to reduce the pressure on bills in the present. However the debt wasn't used to build stuff, it was used to juice up shareholder returns. Now all we have are exhausted balance sheets. Getting out this hole is not going to be as simple as reforming planning.

Introduction

After the Roman Empire retreated from the British Isles, the Anglo Saxons lost the capacity to do all sorts of important things; how to make wheel thrown pottery, glass, and even some forms of iron works. The phenomenon of technological regression made its way into literature. In the 8th century poem, The Ruin, a person wanders the streets of an ancient city (probably Bath), marveling at the civilisation that built such monuments and contrasting it with the decay of the present.

This masonry is wondrous; fates broke it

courtyard pavements were smashed; the work of giants is decaying.

When I read the essay Foundations: Why Britain has stagnated by Bowman, Southwood and Hughes (hereafter the Trio), I was reminded of this poem. The authors take us on a tour of British history lamenting that we don’t build stuff anymore. However, their tour is cherrypicked and superficial. They refuse to acknowledge that the giants of old that built the reservoirs, energy networks and nuclear power stations (that they admire) operated under a system that must not be named; nationalisation.

Sadly the acute case of amnesia seems to be contagious. In a pamphlet called ‘Back to what we’re good at’ the campaigning group ‘Britain Remade’ claimed ‘we owe an enormous debt to the generations that came before us for building the railways, reservoirs, roads, pylons, sewers, power stations and homes we rely on every single day’. But Britain Remade aren’t interested in how Britain was ‘made’ in the first place. Surely a good start to repaying our debt to prior generations is to at least bother to study them? Despite one of modern Britain’s greatest historians, David Edgerton, panning Foundations as ‘regurgitating bad history’, the essay cut through. Apparently it dominated the party conference season. The Sunday Times even gave the Trio a full page spread. One commentator wrote that it was ‘one of the most important essays of our times’.

Foundations can be viewed in two ways. One ‘narrow’ interpretation is that it's an essay that simply says the planning system should be reformed. Viewed this way it isn’t saying anything original. However Foundations has been interpreted to be something far more than that in all the fanfare surrounding the piece. In this ‘broad’ interpretation it is a piece of comparative economic history that explains why growth has ground to a halt in Britain in recent times relative to earlier times and other countries.

As a work of comparative economic history, the argument in Foundations is logically incoherent and unsubstantiated. It lacks foundations. But worse, it demonstrates a lack of curiosity. The Trio don’t seem interested in seeking out aberrant facts, alternative explanations, or case studies that don’t fit their model. Isaiah Berlin divided thinkers into foxes and hedgehogs. ‘The fox knows many things but the hedgehog one big thing’. This Trio are very clearly hedgehogs. They start by formulating a model of the world, and then fit historical facts and anecdotes to it. Their essay is a forager’s litter tray filled with berries and nuts.

The argument in Foundations

Despite taking up nearly 15,000 words, the argument in Foundations is very simple. Britain has a growth and productivity problem. This is due to lack of investment in housing, infrastructure, and energy. This is because it is ‘difficult to build almost anything, anywhere’. The Trio actually claim that Britain has ‘banned’ investment. If allowed, ‘private investors would be rushing to build housing, transport, and energy infrastructure’. Due to the ‘ban’, ‘Britain has denied its economy the foundations it needs to grow on’. Contrast this with France, which is ‘so rich’ because it gets these ‘big things right’. Consequently it can ‘get away’ with things the Trio don't approve of - like strong unions, tax, and regulation.

The Trio argue the ‘ban’ on investment and construction is the reason for Britain’s woes. Of course Britain has other issues, but ‘these other challenges do not explain why a huge economic gap opened up between us and other leading economies since problems in immigration, crime, childcare, tax and political institutions are also found in exactly the countries that pulled away from Britain economically since 2008’. This is important. For the Trio’s argument to be valid on the terms they set themselves, they need to show that their explanation (a bad planning system) is unique to Britain.

What are the barriers to building? If there is a villain in Foundations, it is Clement Attlee. The Trio claim that until the 1940s it was easy for private sector developers to acquire compulsory purchase orders to build infrastructure. In 1947 the Town and Country Planning Act (TCPA) was introduced ‘part of the post war reform programme that nationalised nearly every major industry,... and normalised top tax rates at over 90%’. The Trio claim the TCPA removed the incentive for councils to give planning permission and required developers to get permission from the national government. For the Trio the TCPA is the original sin. They say it led to the green belt and the escalation in central government requirements (from environmental and archaeological surveys to requirements for second staircases). They claim increasing state expenditure won't help because the state ‘would face the same barriers and high costs that existing infrastructure faces’. You can probably see why this argument has won over many Tories. Britain doesn’t need to bother with the hard work of reforming how the state raises and spends money. No, we just need to lay the ghost of Clement Attlee to rest.

If the planning system is the ‘external’ barrier to building stuff, then inefficiency is the ‘internal’ barrier. The Trio say Britain’s high infrastructure costs are due to a host of bad practices; gold plated designs, wasteful environmental surveys, excessive consultations, redesigning projects multiple times, and the lack of a steady pipeline of projects. These habits are all driven by the ‘excessive centralisation of funding and consenting of infrastructure in the national government that has steadily taken place since the 1990s’. The Trio argue centralisation has narrowed the pool of people that both want projects to go ahead and want costs to stay low. And inefficiency creates a ‘doom spiral’; project costs escalate, go over budget, and in turn this makes the central government more reluctant to fund more projects.

Foundations is a familiar argument. If only planning restrictions are removed infrastructure and housing will sprout forth. The Trio are clever enough to not use the words ‘red tape’, but that doesn’t hide the unoriginality of it all. In 2015 the Treasury published a report making many similar claims. It was called ‘Fixing the Foundations’. Countless reports by think tanks, consultants and quangos have commented on internal barriers like ‘gold plating’ (e.g. just recently this report into electricity networks, and this report by the Boston Consulting Group). In fact the 1981 Monopolies and Mergers Commission investigation into the CEGB complained about exactly the same things - gold plating, repeated redesign, surveys and planning delays, the lack of a steady pipeline of work.

A litany of errors

There are three issues with Foundations.

There is limited evidence that the planning system is the problem, and the Trio don’t even suggest an alternative.

It rests on a historically inaccurate account of the patterns of investment under nationalisation and privatisation

Which leads to a flawed account of British economic history since 1850

There is limited evidence that the planning system is the problem

Does the planning system explain Britain’s low investment levels compared to other countries? The Trio claim that ‘since 1947 … Britain has had probably the most restrictive development control system in the world.’ But the Trio don’t present any evidence to justify this claim. We are supposed to just trust that lower investment vs. other countries is because of a worse planning system.

Recently John Springford has pointed out that the Trio’s account of Britain’s housing crisis is flawed, and places too much weight on ‘planningitis’. In energy and infrastructure Foundations rests on two propositions. The Trio don’t test either. Both turn out to be false.

British projects are costlier and more prone to cost and time overruns than other countries.

This is due to the planning system.

Are British infrastructure projects more expensive than in other countries? A recent study by the National Infrastructure Commission (NIC) in 2024 was inconclusive. ‘In most sectors project outturn costs do not vary in a statistically significant way from international benchmarks’. The NIC found some project types where Britain has much higher costs; rail electrification, nuclear generation, high speed rail. But it didn't find a statistically significant gap in railways, water pipelines or wind generation. The Boston Consulting Group analyzed 2,300 rail, road and social (i.e. prisons, schools and hospitals) projects, and found that across all projects unit costs were higher than European peers. But underneath this aggregate results is a more messy picture. Britain has a higher average unit cost in rail than all countries, but in road and social projects the British performance is broadly in line with other countries. Britain struggles with large-scale rail projects, like HS2, while smaller projects align with costs in other countries.

Foundations does not provide sufficient evidence to justify the blanket statement that ‘for a whole range of infrastructure – railways, trams, nuclear power, and more – building has become vastly more expensive than competitors across Europe and East Asia’. All the Trio have done is extrapolate from Hinkley Point C and HS2 (classic hedgehog behaviour).

Figure 1: The National Infrastructure Commission’s analysis of project unit costs across range of infrastructure types

Source: NIC, Cost drivers of major infrastructure projects in the UK, October 2024.

Figure 2: Rail, road and social infrastructure project unit costs

Source: BCG Reshaping British Infrastructure, 2024.

Do British projects take longer than in other countries? Again, the evidence is inconclusive. The BCG report found that across rail, road and social British projects were broadly in line with other European countries (Germany, France, the Eurozone as a whole), but were slower than in Australia and the USA.

Are British projects more prone to cost and time overruns? This is a critical component to the argument made in Foundations. The Trio claim Britain underinvests because infrastructure projects regularly go over time and budget, this leads to cancellations, which blocks other projects from being approved for fear of overruns (the ‘doom spiral’). But BCG found a high level of consistency across countries on cost and time overruns. Britain actually had a lower rate of cost and time overrun than France, Germany and the Eurozone.

Figure 3 and 4: Cost and time overruns for rail, road and social in the UK and comparator countries

Source: BCG Reshaping British Infrastructure, 2024.

Is Britain’s planning system to blame for high costs? Does the variation between countries in unit cost reflect the variation in the planning system? There is no easy way to measure this. A study by the Boston Consulting Group found that British projects spend slightly more time in the planning phase compared to Germany, France, the Eurozone, the US and Australia. The ratio of time in planning total to total project time is 59% in Britain, 56% in Germany and 50% in France and the Eurozone. But when you break this down by sector it is more complex. In rail Britain is clearly behind other countries. But in road and social projects Britain spends less time in planning. More time in planning doesn't necessarily mean higher costs. In road building France takes longer in the planning phase than Britain, but has a lower average cost than in Britain.

Figure 5: Time taken in planning and delivery phases

Source: BCG Reshaping British Infrastructure, 2024.

Planning and permitting rules are something that every country in the world complains about (except perhaps China). A report by the Energy Transmission Commission specifically on planning system barriers to wind and solar observed that 'across the world, projects are consistently held back by planning and permitting challenges, which lead to delays at various project stages'. In South Korea the permitting process for an offshore wind farm can take up to 15 years ‘largely due to lengthy environmental impact assessments, and obtaining community acceptance from the local fishing community’. In the EU poorly designed systems and staff shortages have led to an overshoot of permitting deadlines for onshore wind projects from 24 months to anywhere between 30 months (Romania) and 120 months (Croatia). In Germany opposition to overhead transmission lines has led to the planning, permitting and consultation process escalating to over 10 years (ETC, 2023).

Are the ‘internal barriers’ (goldplating, repeated redesign, poor cost control etc) unique to Britain? No. Everywhere moans about this stuff. Of course Britain can improve here. But it isn’t the case that Britain is unique in facing these problems. Remember, this is the bar that the Trio set themselves when they dismiss a host of other explanations for Britain’s woes.

The explanation in Foundations for how the planning system came to be broken is also confusing. The Trio claim that it all went wrong in the 1940s. Until then it was easy for infrastructure developers to acquire compulsory purchase order powers. Select committees considered requests and created private acts of parliament as long as projects were deemed of national interest. Elsewhere in the essay the Trio claim it all went wrong in the 1990s: ‘the excessive centralisation of funding and consenting of infrastructure in the national government… has steadily taken place since the 1990s’. Which decade is the problem, the 1940s or the 1990s? If Attlee is to blame for our present malaise, why don’t John Major and Tony Blair take some flack? The statement is also factually incorrect. In the 1990s funding of infrastructure was not centralised under the national government. The gas, electricity, water, telecoms and rail sectors were all moved from public into private ownership.

If changes to the planning system in the 1940s are the reason Britain can’t build stuff today, then how come the nationalised industries were so good at building stuff in the 1950s, 60s and 70s? The Trio’s model is incapable of explaining the massive infrastructure projects of these decades; the 275kV supergrid, the massive expansion of coal fired generation, the natural gas conversion programme, the gas transmission system, the nuclear programme, the reservoir boom. The Trio also claim that capital expenditure boomed in the 1980s once Thatcher had initiated privatisation. What made the barriers thrown up in the 1940s surmountable in the 1980s but not the 1990s onward? It doesn’t make any sense.

Given that Foundations argues that Britain will grow again if we fix the planning system, it is surprising that the Trio don’t offer any details about what kind of planning system Britain should have. The Trio are a bit like a builder that points out your ground floor is wet because of a leaky roof, but then scurry off without offering a solution.

Perhaps the reason for this omission is because it would mean facing up to some uncomfortable ideas. Foundations claims that France’s prosperity is in spite of high taxes and high levels of business regulation. It can ‘afford such a large interventionist state because it does a good job of building the things that Britain blocks’. It doesn’t seem to occur to the Trio that France may be able to build things because of a large interventionist state. But Foundations doesn’t say anything about how the French planning system works. Nor how that planning system has been built around the state having stakes in a number of industries (the water and energy systems are nationalised).

The Dutch model for offshore wind is often cited as an example of effective planning and permitting. The state undertakes the site mapping and selection, environmental surveys, consenting, granting of permits. It guarantees a timely connection and arranges the tender (see ETC, 2023). The Dutch Transmission network - Tennet - is 100% state owned, unlike the three British transmission networks. And in the Netherlands onshore and offshore transmission are fully integrated. Unlike in Britain where they were separated (just one example of Britain’s zeal for ‘unbundling’). The Danish approach to offshore wind is similar. The state auctions off licenses to specific sites that are pre-cleared for development and come with a grid connection (see Bell, 2023). As in the Netherlands the Danish transmission operator, Energinet, is fully state owned and responsible for both onshore and offshore.

A flawed account of nationalisation and privatisation

The reason why the Trio are so focused on the planning system is because they believe that if only barriers were removed then private capital will flood in and stuff will get built. This rests entirely on an interpretation of privatisation in the 1980s and 1990s.

(a) Underinvestment

Early on in Foundations, the Trio reveal their hand. They claim ‘privatisation, tax cuts, and the curbing of union power fixed important swathes of the UK economy. Crucially, they tackled chronic underinvestment in sectors that had been neglected under state ownership. Political incentives under state ownership encouraged underfunding - and where the treasury did put money in, it tended to go on operational expenditure (e.g. unionised workers wages rather than capital investments).’

The Trio’s own graph shows that such a sweeping statement is nonsense (figure 6). Gross fixed capital formation as a percentage of GDP rose dramatically from 1945-1970 during a period when many industries were nationalised. Capital formation rose briefly from 1982 to 1990, which was a transition phase from nationalisation to privatisation. From the 1990s there has been a persistent gap between Britain and France, Germany and the USA. The claim ‘political incentives under state ownership encouraged underfunding’ does not fit the international record. The German and French economies were more nationalised than the British between 1950 and 1970. Germany and France invested a higher share of GDP than Britain and the USA. The USA’s economy on the other hand was overwhelmingly under private ownership. In 1970 non-residential investment was 16.3% of GDP in France, 19.6% in Germany, 14.6% in Britain and only 13.5% in the USA (Crafts, 2017).

Figure 6: Investment as a share of GDP, 1960-2022.

The claim that Treasury funding tended to go on operational expenditure and not capital investments is also nonsense. The ratio of capital expenditure funded by prices was known as the ‘self financing’ rate. Between 1950 and 1980 across all state owned corporations the ‘self financing’ level peaked in 1969 at 44% but then fell down to 11% in 1975 (see Millward, 2005). In other words 89% of capital expenditure came from the state.

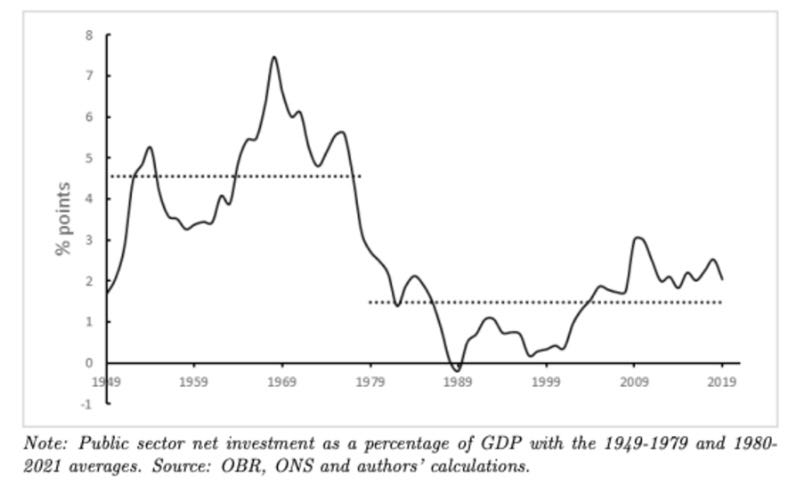

A study that the Trio cite concludes that ‘public investment as a share of GDP only dropped to a much lower long term average after 1979 and the GDP share of business investment also trended downwards from the early 1990s’ (Chadha and Samiri, 2022). Since comparable records began in 1948 the largest annual increase in public sector net investment was in 1951-52 (OBR, 2024). Public investment only plummeted under Thatcher from 1979. Private sector investment did not substitute for falling public investment, and economy-wide chronically low investment set in from the early 1990s (Florio, 2004, p. 93-94).

Figure 7: UK Public Sector net investment as a % of GDP

Source: Chadha and Samiri, 2022

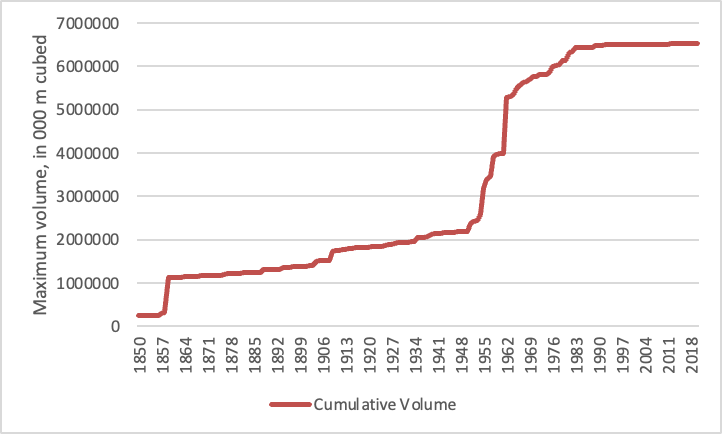

The Trio lament that ‘Britain has not built a new reservoir since 1992’ in their opening list of random facts. What happened before 1992? The Trio aren’t interested. Between 1950 and 1976 the reservoir system was expanded at a dramatic rate. Reservoir capacity grew 82% in the 1950s, 45% in the 1960s, 6% in the 1970s and 1980s, and just 1% in the 1990s, 2000s and 2010s. This wasn’t a centrally directed programme of works. Between 1945 and 1973 the water sector was almost entirely in public ownership and was highly fragmented. In 1956 there were 1,030 ‘statutory water undertakings’, mostly local authorities. Over the 1960s and early 1970s the industry was consolidated into just 198 entities. It is strange that Foundations doesn’t have more to say about the water sector. Maybe because the Thames Water debacle makes the sector a poor advertisement for privatisation.

Figure 8: Reservoir capacity from 1850-2020

Source: Inventory of reservoirs amounting to 90% of total UK storage to 2018. https://catalogue.ceh.ac.uk/documents/f5a7d56c-cea0-4f00-b159-c3788a3b2b38

What about energy infrastructure? Between 1950 and 1979 energy investment in fixed assets (or Gross Fixed Capital Formation) was on average 1.22% of GDP, peaking at 2.0% in 1967. Between 1979 and 1990 in the transition to privatisation it was 0.63%, and since 1990 it has been 0.54%. Figure 9 shows the capacity of the electricity system rocketed from 1950 to 1970. But from the late 1960s the CEGB continued to build capacity even though the amount of unused capacity was growing. For many decades economists have claimed that the problem wasn't underinvestment, it was overinvestment. Between 1980 and 2000 capacity hovered around a similar level, while the unused margin narrowed. Capacity grew again from 2000-2010 but then fell down to 2020. There are lots of factors that explain the trend. Alas, history is complex. The idea that it was privatisation in the 1980s that unleashed investment is nonsense.

Figure 9: Capacity of electricity system, 1950-2022.

It is a similar story in electricity networks. Between 1950 and 1970 the Central Electricity Board and the Area Boards built networks at a breathtaking pace and scale. Because the network had been built, it didn't need expanding for decades. The post war engineers built an endowment that subsequent generations lived off. You might even say that the CEGB built strong foundations for economic growth. The network was a platform that created optionality. In the 1990s the ‘dash for gas’ was fueled by private finance. But the ‘dash’ was only possible because the electricity network was already there. Coal fired generation sites were reused for new CCGT generators, Electricity transmission and distribution capex rose slowly and steadily from 1990, but it didn’t need to grow sharply thanks to the CEGB. Between 50% and 80% of electricity network capex since 1990 has actually been on refurbishing or replacing the existing asset base, as opposed to ‘load related capex’ which is to expand the capacity of the network.

Figure 10: Electricity network capex, 1948-2020

The energy section of Foundations culminates with a grand reveal. The hero that will ride in to save Britain from its energy woes has been there all along… nuclear power. The Trio lament that the last nuclear power plant was built between 1987 and 1995 and that the next one will be Hinkley Point C, which is ‘between four and six times more costly per megawatt of capacity than South Korean nuclear power plants’. But the Trio don’t mention that KEPCO is 51% state owned. They praise the French nuclear programme from the 1970s. But they omit it was the work of the state owned EDF. They even praise Britain’s own nuclear record: ‘In 1956 we became the first of all countries to move to the energy technology of the future: nuclear. In its early years, Britain was the world leader in nuclear power.’’ But they don’t say this was the work of the nationalised Central Electricity Generation Board.

The Trio don't investigate whether state ownership is a necessary precondition for nuclear power because of the extraordinary costs involved. Britain's first reactor at Calder Hall in 1952 was a demonstrator project, so cost overruns and unfavorable economics were ignored. But the 1955 White Paper made it clear that the reactors would need to receive ongoing subsidies to be viable. As early as 1960 the Ministry of Power recognised that the date that nuclear might be cost competitive with coal was being constantly pushed back, driven by cost overruns, construction delays and the fact coal prices kept falling. One economist later estimated that the Magnox programme cost £9.7 Bn more than if the CEGB had gone with conventional coal power plants (see Baker, 2023).

The state protected nuclear energy despite its economic shortcomings because it served broader macro economic objectives. The goals of the first nuclear programme in 1955 were, in order of priority, to create a market for British designed reactors, develop an export trade, and cost efficient energy supply. In other words, the nuclear programme was incubated by the state to serve broader macro economic objectives. One of the consequences of this logic was that the British made AGRs were favored over the American PWRs in the 1960s, which meant locking in an inferior technology. In the 1960s the CEGB recommended moving to the PWRs but the UKAEA favored its own AGR technology. Under the third nuclear programme from 1974, the CEGB was told to go with the AGRs to protect the National Nuclear Corporation (see Nuclear Development in the UK, 2016).

Foundations claims that in Britain ‘private investment is blocked from going where it could generate the highest returns’. But French, South Korean and British nuclear power doesn't exist because private investment was unleashed and chased high returns. It exists because the state invested in something with low returns.

The Trio also skip over the role that privatisation played in the decline of nuclear power. In the 1980s Margaret Thatcher's government planned to develop a new fleet of nuclear stations. But it became apparent that new nuclear stations were much more expensive than building a new fleet of gas fired stations. It wasn't the state that made this decision. The newly privatised companies that made up the old CEGB took a look at the profitability and long term decommissioning liabilities and refused to take on the nuclear assets. Just days after Thatcher had praised nuclear power as a solution to climate change at the UN, plans for a fleet of new PWRs were shelved (Adam Bell, 2024 McCullogh, 2023). Only one plant was constructed, Sizewell B (a PWR) in 1995. As David Edgerton noted in a stinging review of Foundations, ‘Privatisation exposed the real economics of nuclear power, long deceitfully concealed by the state’. It is perfectly reasonable to criticize the nationalised energy industry for choosing AGR over PWR technology (as someone from Britain Remade did here). But the same bar should be applied to the privatised industry, which also decided against building PWRs and went with CCGTs instead.

The combined-cycle gas turbine (CCGT) represented a very different kind of techno-economic system to nuclear power; they were less capital intensive, smaller, modular and quicker to build. In the 1990s Britain had one of the fastest booms in gas fired generation in the world. As one industry insider explained ‘Pre-privatisation a CCGT would have always lost out because of the investment appraisal used. Private sector discount rates of 15% to 20% mean the economics swing from fuel to capital. CCGT plant are essentially modular… ten years… the time needed to build an old CEGB plant…. is a lifetime in the capital markets. We built Rooscote [a CCGT plant] in 24 months.’ (see Winskel, 2002).

The term ‘dash for gas’ is apt. The nuclear programme required patient capital and was focused on building engineering and supply chain ‘foundations’. The dash for gas was driven by impatient capital. Infrastructure got built, but with long term consequences which we are still living with. The ‘dash’ is one of the main reasons why Britain’s electricity is extremely expensive. The Trio blame high energy prices on intermittent renewable generation. They don’t mention our exposure to gas prices and a daft market structure where gas sets the price.

If the legacy of the 1940s matters then so should the legacy of the 1980 and 90s. Rather than blame everything on Clement Attlee, the Trio should look at Thatcher and Lawson. Elsewhere they claim Britain has become ‘energy starved’ with lower consumption of electricity per capita than France. But the timing of this flip contradicts their narrative that Britain ‘fell behind’ in the immediate post war period. Actually quite the opposite. France only overtook Britain in electricity consumption per capita in 1980 after Thatcher’s election. On this metric the nationalised industry was even more successful; from 1950 to 1980 electricity consumption grew at the fastest rate in British history and faster than in France.

Figure 11: Electricity consumption per capita in France and UK, 1920-2020.

Source: Millward, 2005, p.198, 222-223; Our World in Data (here); Malanimi, 2020.

Another issue with Foundations is that it says very little about how electricity markets should be structured. This is strange given the debate going on in the sector. This leads to a bigger question mark about how they think energy assets should be remunerated. Who exactly should ‘call KEPCO, asking how many nuclear reactors it could provide’? Should the state own and operate the plant? Or should private companies be given access to a Regulated Asset Base model? Or maybe a contract-for-difference? Or nothing at all? The failure to say anything about the commercial model for nuclear energy could be an innocent omission. Or it could be hiding a more sinister plan. Apparently some industry insiders are pushing for AI data centres to be supplied by “Small Modular Reactors”, but want these SMR’s be paid for from consumer bills. These lobbyists are apparently in favour of a ‘pay before delivered’ model used in water where bill payers have to pay financial institutions before any infrastructure is built. A good term for this might be ‘techno-feudalism’; the citizens of Britain are taxed to pay for the future infrastructure of their elite overlords.

The discussion of rail electrification is another spectacular example of ‘hedgehog-ery’. They start with the claim that buccaneering private companies pioneered rail electrification: ‘In the 1890s, electrification rapidly transformed intra-city rail transport. In London alone, the Northern, Piccadilly, Bakerloo, Central and Waterloo & City Lines were opened between 1890 and 1906’. But they don’t compare to other countries. In fact inner city rail electrification was woefully behind the USA (see Millward 2005, Hughes 1983) due to Britain’s inefficient and fragmented electricity system. The Trio then zoom forward in time, skipping out a century of history, and argue Britain is now terrible at rail electrification compared to other countries.

What on earth happened between 1906 and 2020 to explain how Britain went from electric rail pioneer to laggard? The Trio aren't interested. They make the point then scurry off to the next. Analysis in a recent report by the National Infrastructure Commission helps illuminate the problem. Figure 12 shows the rate of rail electrification in Germany and Britain from 1968-2018. Germany’s railways have been in public ownership since 1949. It has methodically electrified at a steady rate since 1968. In contrast Britain’s railways have switched between public and private ownership. The railways were nationalised between 1948 to 1995. There were spikes in electrification in the 1970s, followed by a huge increase in electrification rates between 1984 to 1990. But at that point electrification rates dropped off a cliff. The moment the railways were privatised marked the beginning of 20 years of abysmally low electrification rates. To make things more complex, Railtrack was renationalised in 2002 as Network Rail after a series of fatal crashes (Southall, Ladbroke Grove, Hatfield, Potters Bar).

Figure 12: Rail electrification in Britain and Germany, 1968-2018.

Source: NIC, Cost drivers of major infrastructure projects in the UK, October 2024.

Privatisation is a reason why Britain has failed to electrify railways like Germany. This is the view of practitioners in the field. Gary Keenor, a Technical Director and Head of Electrification at the engineering firm Atkins explains in his textbook on rail electrification:

‘Privatisation broke the link between infrastructure capital cost and train maintenance saving which was vital to justify the initial cost of electrification schemes. The splitting of rolling stock procurement, rolling stock operation and infrastructure ownership led to a huge increase in diesel procurement, as no organisation would benefit from the whole life advantages of electric traction’ (Keenor, 2022, p.18).

(b) Efficiency and performance

Another central claim to Foundations is that public ownership means poor cost control, which sets off a death spiral of overspend, delays and cancellations. The Trio think the private sector is always better, because ‘private companies may literally cease to exist if they fail to deliver their product while keeping costs reasonably low’. And ‘no public body will ever quite have quite the existential interest in cost control than a private one does’.

This is also nonsense. The Trio contradict themselves within a few paragraphs. They claim local authorities are good at controlling costs because ‘local councilors will be punished severely by the small local electorates who have to pick up the bill generated for their mismanagement’. ‘Financially responsible local governments have a vivid interest in keeping costs down if they are on the hook for them’. Why would either statement be untrue for the central government? The Trio give a number of examples of local authority led projects that successfully control costs. For instance, the French cities that fund 50-100% of the cost of mass transit projects and ‘unsurprisingly they then fight energetically to suppress cost bloat, and they generally succeed’.

The Trio actually argue the case for municipal ownership. They say that with skin in the game the local state unblocks the planning system and keeps costs down. It is strange that they don’t push this point, as it might have led them to a very different set of recommendations. Why not have local authorities take an ownership stake in water companies, onshore generation assets, rail franchises, distribution energy networks and other kinds of regional infrastructure. Surely this would reduce local obstructionism and cost bloat?

The Trio’s beef isn't really with public ownership, it is with centralisation and national monopolies. In Britain national monopolies can be public (like Network Rail which is owned by the state) or private (like National Gas Transmission which is owned by Macquarie). The Trio say that the central government can't control costs because it can always socialise the costs over everyone, leading to the ‘big number is really a small number’ fallacy. They cite the fact the Lower Thames Crossing can spend £300m on consenting ‘but it still comes to less than £5 per British person’. It may horrify the Trio to find out that many privately owned energy infrastructure companies regularly apply the exact same logic that a large number is actually a small number when divided by all their customers. Energy networks regularly ask for billions of pounds for projects on the justification ‘it’s only a couple of quid’ on the bill. Take the examples below (figure 2 and 3). A screenshot from page 5 of National Gas Transmission’s 2022/3 annual reports. Or from National Grid Electricity Transmission’s 2019 submission to Ofgem for funding over the period 2021-2026; the company asked for £7.1 Bn of allowances on the basis it would only come to £23.6 on the bill. The two numbers are literally next to each other on page 5 of the document.

Figure 13: How privately owned National Gas Transmission applied the ‘big number → small number’ fallacy.

Source: National Gas, Annual Report and accounts, 2022-23.

Figure 14: How privately owned National Grid Electricity Transmission applied the ‘big number → small number’ fallacy.

Source: NGET business plan, 2021-26, December 2019.

There are many studies that show that private ownership does not have a significant impact on efficiency relative to public ownership (see Parker 2004, Florio, 2013, Florio, 2004, Saal et al 2007). Of course there are examples of state directed and owned projects going over budget. But there are many examples of them going very well. Between 1953 and 1970 the Central Electricity Generation Board built a new ‘Super Grid’. At 275kV it was double the voltage of the highest voltage ever used. It was ahead of schedule and on budget, and even included a few 400kV circuits for good measure. All at a time of post war manufacturing shortages and significant political pressure to end blackouts (see here for more details).

Or take the natural gas conversion programme (see here). Between 1966 and 1977 the nationalised gas industry switched feedstock from gas made from coal and oil to natural gas (both from the North Sea and liquified). It was a gargantuan mega project. A vast transmission network was constructed at an average rate of 227 miles per year but at peak in 1967 and 1968 600 miles per year. Across 13.4 million homes 35 million appliances were replaced or retrofitted in just 10 years. The British conversion programme was the most successful in the world. The Dutch only managed 2 million customers in 5 years, and the Japanese 5 million customers in 10 years. The complexity was breath-taking. A census of appliances between 1967-9 revealed there were nearly 8000 different types of appliances that needed to be replaced or adapted. The coordination of infrastructure planning and customer engagement was also remarkable. Each Area Board would plan when a household would undergo conversion. Within 10 hours of ‘C-Day’ all essential appliances were set up for natural gas and the network would turn on the flow. All of this was done at no direct cost to the end consumer. The whole programme was on time and under the budget of £8.8Bn (in today's prices) (see R. Thomas, Lessons Learned, and here).

Gas conversion isn’t mentioned once in Foundations. It is a staggering omission. It would be like writing about the history of Rome and not even being aware of the colosseum.

The fate of British nuclear power between 1990 and 2002 is another fascinating story that undermines the Trio’s belief that the private sector is always superior. Between 1996 and 2002 nuclear power was briefly and unsuccessfully privatised under the company British Energy. It inherited assets that were actually performing very well. Between 1990 and 1996 two new government entities (Nuclear Electric and Scottish Nuclear) had executed a remarkable turnaround. By focussing exclusively on nuclear, and with nowhere to hide losses, productivity improved dramatically. The workforce was cut from 13k to 9.5k, and load factors were improved. In March 1993 Nuclear Electric announced an average load factor of 73.9%, which narrowly beat the 73.2% achieved by the fleet of PWRs in the USA. The two organisations were merged under British Energy, which was privatised in 1996.

After an initial spell of good performance, things started to go wrong. Good operational performance translated into high payments to shareholders, but not adequate investment in the plant. This led to several unplanned outages. British Nuclear also fell foul of its grand ambitions. In 1997 it formed a joint venture to acquire nuclear plants in the US. In 1999 it attempted to increase its market power by vertically integrating and buying energy retail businesses. In 2000 it moved into coal fired generation in Britain and Canada as a hedge. By 2002 the company was overstretched. From 1999 the AGR’s performance began to decline, but British Energy continued to pay shareholders large dividends and take on debt to fund expansion. Falling power prices and the end of subsidies (the Fossil Fuel Levy) ultimately led to financial collapse. British Energy was renationalised in 2002. In 2005 the Nuclear Decommissioning Authority took over the liabilities of the UK’s legacy plant and facilities (see Nuclear Development in the UK, 2016 and Baker, Nuclear Power, 2023). Excessive profits, overexpansion, mismanagement and a state bail out; there is an eery similarity to the story of Thames Water.

A flawed economic history of Britain

Foundations contains an entire section on the history of British productivity. It argues that things were great until the 1950s then Britain fell behind other countries, but thanks to Thatcher things turned around in the 1980s. The insinuation is that today we need to copy and paste the 1980s.

The Trio claim that ‘between the mid-eighteenth century and the late nineteenth century, Britain was the world’s leading economy’. They attribute this to a number of factors, but one in particular was an advanced transport system. Apparently from ‘the eighteenth to the early twentieth centuries, Britain had easily the best transport infrastructure in the world’.

These claims aren’t supported by the economic record. Figure 15 compares labour productivity before the First World War in the UK and the USA. What is interesting is that Britain lagged the most in transport (0.7% growth per annum vs 2.5% in the USA). At the beginning of the 20th century Britain did not have the best transportation system in the world, nor even the best in Europe. British railways were in the middle of the pack. Out of eighteen countries with significant rail networks, Britain was only the 10th most efficient for the period 1890-99, and only the 7th most efficient for the period 1900-1912 (see Bogart, 2010). The privatised companies that ran Britain’s railways weren’t actually very good managers. Company-level productivity was highly varied in terms of total factor productivity growth and there was substantial cost inefficiency. Crafts, Mills and Mulatu argue that the ‘wider implication is that the neoclassical exoneration of late-Victorian British management may be less convincing for the services sector than for manufacturing’ (see Crafts, Mills and Mulatu, 2007).

Figure 15: Sectoral labour productivity growth before the First World War, % per year.

Britain was also extremely far behind the USA in utilities (1.4% growth per annum vs 4.0% in the USA between 1870-1910). By the start of the First World War the British electricity and gas system was a mess. Excessive competition had left a patchwork quilt of overlapping energy supply undertakings meaning the system was extremely inefficient. In 1914, of the ten largest Western cities, London had the lowest output of electricity per capita, the lowest load factor (a measure of the efficiency of the electricity system), but its utilities had the highest profit levels (Hughes, 1983, p.228). This had a long term ‘path dependent’ impact, as subsequent generations had to undertake the painful work of rationalizing and reorganizing the system. State intervention was critical. First through the state owned Central Electricity Board in the late 1920s and 1930s, and then later in the 1940s and 1950s under the fully nationalised industry. The Trio praise the work of the Central Electricity Board in the 1930s, but fail to mention that it was only brought into being because the private ownership and competition had spectacularly failed by the 1920s.

Turning to the “bad times”, Foundations makes a mainstream argument about the immediate post war period. Between 1950 and 1973 Britain experienced its fastest ever growth in real GDP per person. But when compared to other countries it was a period of relative economic decline. The Trio note that the ‘reforms of the late 1940s, largely under Clement Attlee’s governments, caused Britain to grow more slowly than any other major European country and the US until the mid-1980s. Britain was overtaken by Germany, France, the Netherlands, Belgium, Denmark, Italy and Switzerland.’

It is worth noting the contradiction in the argument. In the period from 1870-1915 Britain fell behind the economic growth rates of the USA. But the Trio don't see this as a failure because Britain kept growing and remained ahead of other European countries. However the period between 1950-1973 is deemed a failure because Britain fell behind France and Germany, even though GDP growth was stronger than in the USA (1.74% GDP growth per annum from 1950-1973 in the UK vs 1.49% in the USA - see Crafts, p.84). As one of the Trio stated elsewhere ‘if a country is converging on the frontier, it's doing well.’ Between 1950-1973 Britain did converge on the frontier, with higher total factor productivity growth than the USA in most sectors and higher GDP growth overall.

Nationalisation was an economy wide programme with mixed results. On aggregate Britain experienced relative economic decline when compared to Germany and France. But in some of the sectors, like energy, performance was more favorable. Over the period 1950-1973 Britain’s electricity and gas industries experienced an average annual growth rate in total factor productivity of 5.5% and 4.71% respectively, which was much higher than in the USA for the same period (3.4% in electricity and 3% in gas). Between 1973 and 1995 this figure fell to 1.5% in electricity, behind the USA (2.6%), France (3.7%) and Germany (2.5%). The economists O’Mahoney and Vecchi concluded that the ‘productivity record after privatisation was unremarkable relative to its own past experience and other countries’ (see Millward, 2005). Between 1995-2015 the average total factor productivity growth in water, gas and electricity has been around -2.3%, which is less than in the same sectors in the US, Germany and the Netherlands (see Ajayi et al, 2018).

Foundations doesn’t investigate the reason for Britain’s relative economic decline in the immediate post war period. The Trio simply blame Clement Attlee and nationalisation. But this doesn’t explain why France and Germany were so successful at catching up on the USA and overtaking Britain. As figure 15 shows, by 1971 the French and German economies were more nationalised than Britain. Publicly owned enterprises had a greater share of employment, fixed capital formation and net output.

Figure 16: Public enterprise shares of economic activity, 1971. Percentage of national totals

A different question the Trio could have asked is why nationalisation led to better overall economic outcomes in Germany and France than in Britain? One of the most influential arguments on the subject is that put forward by Barry Eichengreen. France and Germany had high investment rates because of a successful social contract which sustained wage moderation by workers in return for high investment. These countries were ‘Coordinated Market Economies’. The state monitored capitalists and workers compliance. In return for centralised wage bargaining and pay restraint, workers received the benefits of an expanded welfare state. Another factor, which does not get a mention in Foundations, was the European Economic Community. Investment by both private sector and public sector firms was more profitable if they were free to sell beyond their national frontiers, which is why European integration was so important to the national growth plans of France and Germany (O Rourke, p.80). The UK didn't join the EEC until 1973. Joining raised GDP in the UK by about 8 to 10 percent through increasing the volume of trade and strengthening competition (Crafts, 2018, p.93).

French nationalisation was just as sweeping as in Britain; electricity, gas, Air France, Renault, the mining sector, the Banque de France, the four major commercial banks, and 50% of the insurance industry were all taken into public ownership. Although where French nationalisation differed was in being far more geared towards ‘modernisation’ and being more democratic. Unlike in the UK, nationalisation united the main political parties. Workers had a greater influence over the programme through the Communist backed trade union federation the CGT, which was able to exert influence in the critical formation stages of economic planning and in the governance of the nationalised sectors. There was also a stronger commitment to giving different interest groups representation on boards. (see A Cumbers, 2019). Britain’s nationalisation was more elitist and technocratic. There was no commitment to any kind of elected membership or co-determination principles, which were common in most Western European and Nordic countries after 1945 (A Cumbers, 2019). Without as much of a say, workers and trade unions had a lesser incentive for wage moderation. This undermined the kind of long term modernisation programme that France and Germany were able to pursue.

Britain’s nationalisation programme was also more half hearted. Industries may have been nationalised, but certain features from the late nineteenth century remained in place. In particular, decentralised wage bargaining and the separation of ownership and control. This also undermined wage moderation and modernisation (Crafts 2018, p.94). For the great economic historian Nicholas Crafts ‘idiosyncratic institutions, namely, the British systems of corporate governance and industrial relations, which lie at the heart of Britain’s post war productivity failure can be seen as the grandchildren of designs which date back to the days of the early industrialisation and which differ from that of European countries that industrialised later’ (Crafts, 2017). So to follow the same logic as the Trio, falling behind the French and Germans wasn’t so much the fault of Attlee as the fault of the Victorians.

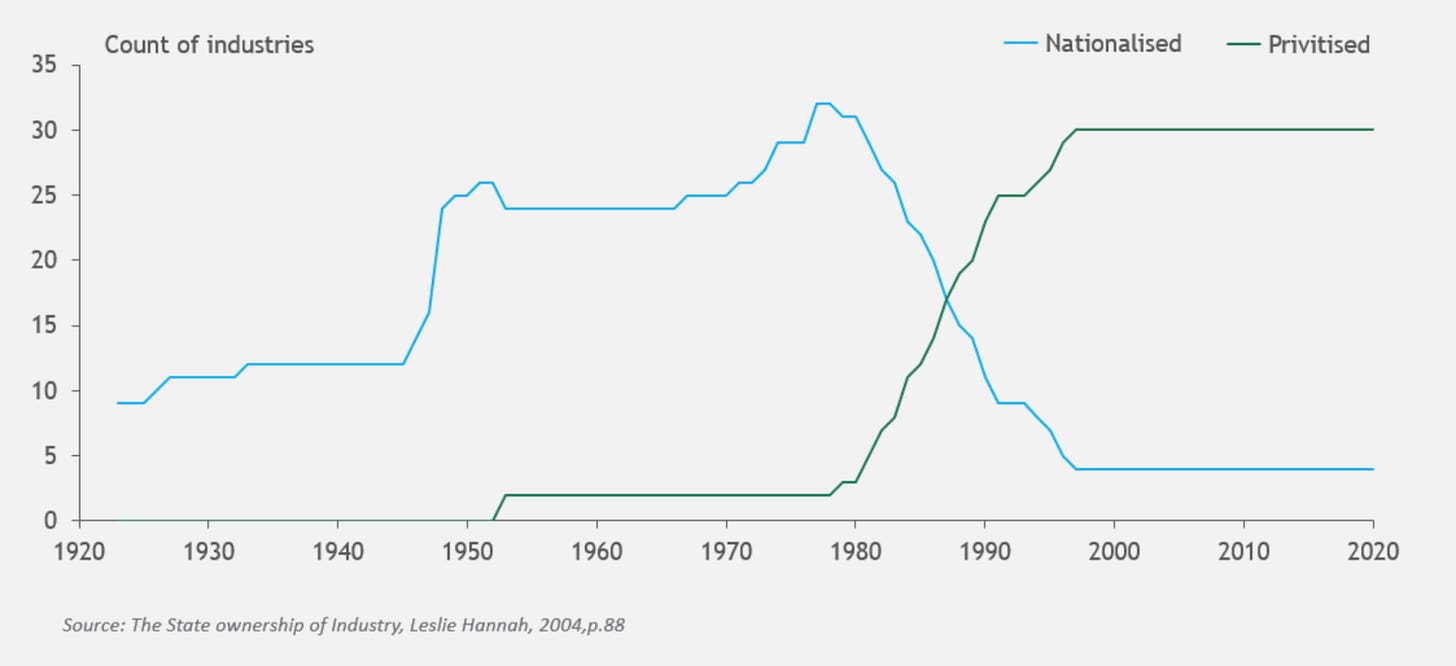

Conclusions

Foundations is correct to argue that Britain needs a ‘systematic programme of reform’ and that this must begin with a comprehensive understanding of ‘which of Britain’s institutions have failed and why they have done so’. But I think they are muddled about which institutions need fixing. They see the story of the last 20 years as evidence that Britain’s ‘postwar institutions have manifestly failed’. It is an odd and revealing turn of phrase, because there really is very little left of Britain’s post war institutions when it comes to infrastructure and energy. Privatisation completely changed the political economy of Britain.

Figure 17: Ownership of industries since 1920

An alternative view is that underinvestment is due to bigger problems with the British economy and in particular the privatised model. Getting out this hole is not going to be as simple as reforming planning. For anyone on the centre or the left that read Foundations and felt good about the simplicity it offered, I am sorry to disappoint. That will be the subject of a future blog.

Thanks for putting this all in one place, really interesting. What is your policy prescription? Renationalisation? Or are nationalised coordination type reforms enough (e.g. NESO)? If renationalisation, do you have views on how that could be done and what the costs would be?

As I was complaining about a previous post, this is actually very good.